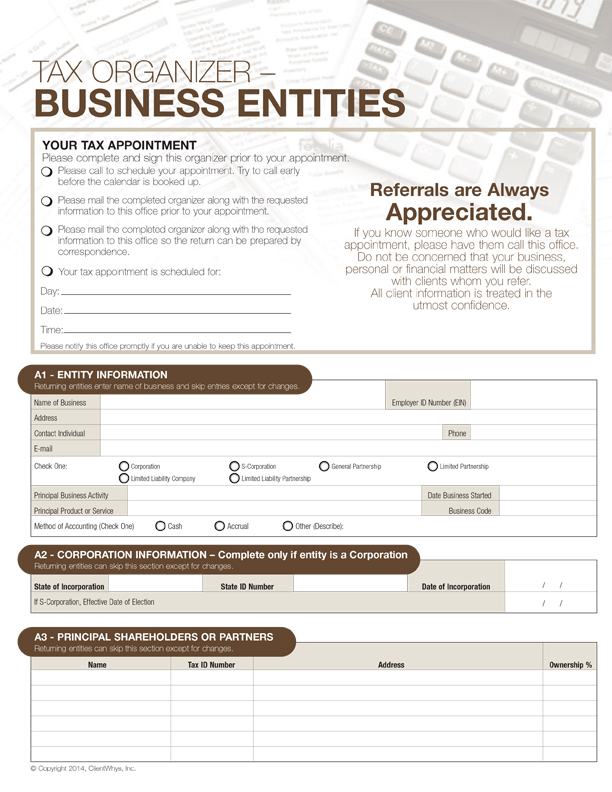

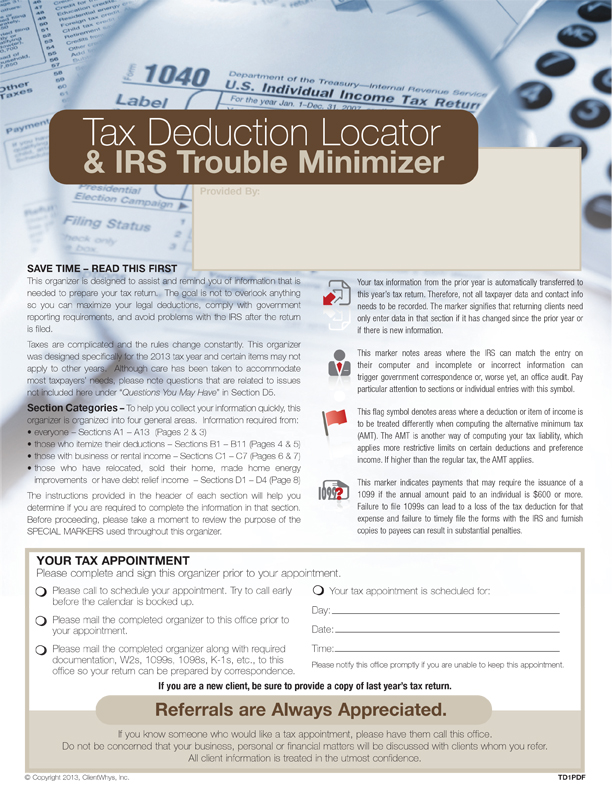

So you’ve made a tax preparation appointment with a Strother’s Bookkeeping tax pro. But do you know exactly which documents you’ll need to bring to the appointment?

Getting organized for your appointment is often the most difficult step — and our checklist has everything you’ll need for your specific tax situation. Note that not all categories listed on this document will apply to you (you may not be in a federally-declared disaster area, for example), but it’s a good idea to read each item to make sure you’re not overlooking any documentation that may not be top-of-mind.

Use this simple guide to prepare for your tax appointment. The documents that you will need to bring to your appointment are listed below. Depending upon your individual situation, other supporting documents may be required to complete your return.